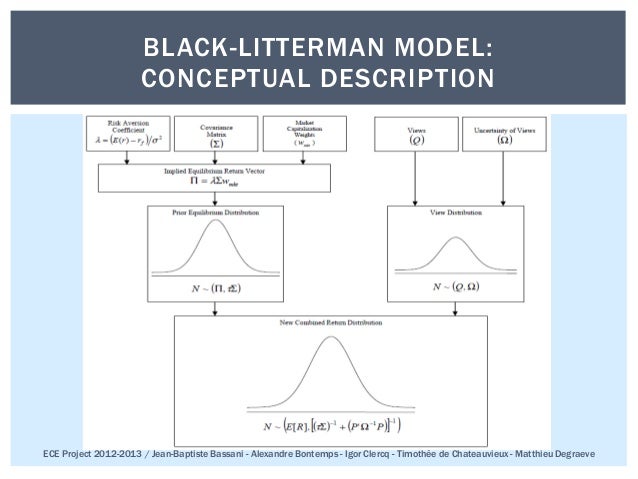

Tools to calculate assets clusters based on codependence metrics. Tools to calculate uncertainty sets for mean vector and covariance matrix. Tools to calculate risk contributions per asset. Tools to build views on assets and asset classes. Tools to build linear constraints on assets, asset classes and risk factors. Tools to build efficient frontier for 13 risk measures. Portfolio optimization with constraints on number of assets and number of effective assets. Portfolio optimization with short positions and leveraged portfolios. Portfolio optimization with constraints on tracking error and turnover. Portfolio optimization with Augmented Black Litterman model. Portfolio optimization with Black Litterman Bayesian model. Portfolio optimization with Risk Factors model. Portfolio optimization with Black Litterman model. Relaxed Risk Parity Portfolio Optimization. Worst Case Mean Variance Portfolio Optimization. Nested Clustered Optimization (NCO) with four objective functions and the available risk measures to each objective:

Ulcer Index for uncompounded cumulative returns.Entropic Drawdown at Risk (EDaR) for uncompounded cumulative returns.

Conditional Drawdown at Risk (CDaR) for uncompounded cumulative returns.Average Drawdown for uncompounded cumulative returns.Maximum Drawdown (Calmar Ratio) for uncompounded cumulative returns.Worst Case Realization (Minimax Model).Second Lower Partial Moment (Sortino Ratio).First Lower Partial Moment (Omega Ratio).Mean Risk and Logarithmic Mean Risk (Kelly Criterion) Portfolio Optimization with 13 convex risk measures: Mean Risk and Logarithmic Mean Risk (Kelly Criterion) Portfolio Optimization with 4 objective functions: Some of key functionalities that Riskfolio-Lib offers: Its objective is to help students, academics and practitioners to build investment portfolios based on mathematically complex models with low effort. Or portfolio optimization in Python made in Peru 🇵🇪. Riskfolio-Lib is a library for making quantitative strategic asset allocation

0 kommentar(er)

0 kommentar(er)